Every successful business has one thing in common—they know their market inside and out. Whether it’s understanding what customers want, keeping tabs on competitors, or spotting trends before they take off, having the right information can make or break a company’s strategy. But how do you gather market intelligence without drowning in data or wasting time on the wrong insights? In this guide, we’ll break it down step by step, showing you exactly how to collect, analyze, and use market intelligence to make smarter business decisions.

What is Market Intelligence and Why Does It Matter?

Market intelligence is the process of gathering and analyzing data to understand competitors, customers, and market trends. It helps businesses make informed decisions, adapt to industry changes, and stay ahead of the competition. Instead of relying on assumptions, companies use market intelligence to track real-world insights that drive strategic planning.

Benefits of Market Intelligence

- Understanding Customers – Analyzing customer preferences, behaviors, and feedback to improve products and services.

- Predicting Trends – Identifying market shifts, economic changes, and industry innovations before they gain momentum.

- Staying Ahead of Competitors – Tracking competitor pricing, marketing strategies, and product developments to refine business strategies.

By leveraging market intelligence, businesses move from reacting to changes to anticipating and preparing for them.

Market Intelligence vs. Other Business Insights

Market intelligence is often confused with other types of business insights, but each serves a different purpose. While all forms of intelligence help businesses make data-driven decisions, their focus and application vary. Below, we break down the key differences between market intelligence, marketing intelligence, business intelligence, and market research to clarify their unique roles.

Market Intelligence vs. Marketing Intelligence

- Market intelligence provides a broad view of an industry, including customer behavior, competitor strategies, and market trends. It helps businesses make strategic decisions beyond marketing, such as product development or pricing adjustments.

- Marketing intelligence, on the other hand, focuses specifically on marketing performance—measuring advertising effectiveness, customer engagement, and conversion rates to refine marketing campaigns.

Example: A company like Nike uses market intelligence to track competitors like Adidas and Puma, analyzing their pricing strategies and product launches. Meanwhile, Nike’s marketing team might use marketing intelligence to assess the success of an ad campaign and adjust their messaging accordingly.

How they work together: Marketing intelligence is a subset of market intelligence. While marketing intelligence helps improve campaigns, market intelligence supports wider business strategies by analyzing industry trends and competitor activity.

Market Intelligence vs. Business Intelligence

- Market intelligence looks outward at industry conditions, competitors, and customer trends. It helps businesses understand their external environment and position themselves effectively in the market.

- Business intelligence (BI) is internal-facing, focusing on company data such as sales performance, operational efficiency, and financial health. BI helps businesses optimize processes and measure success.

Example: A SaaS company like HubSpot might use business intelligence to analyze its revenue growth, customer churn rate, and sales performance. Meanwhile, it would rely on market intelligence to track emerging competitors, pricing trends, and customer sentiment about similar products like Salesforce and Zoho CRM.

How they complement each other: Business intelligence tells a company how well it’s performing, while market intelligence provides context by showing how it compares to competitors and industry trends

.

Market Intelligence vs. Market Research

- Market intelligence is ongoing—continuously tracking competitor moves, industry trends, and consumer behavior to make real-time decisions.

- Market research is more project-based—often used to gather specific insights on a product, target audience, or campaign through surveys, focus groups, and interviews.

Example: Before launching its iPhone SE model, Apple likely conducted market research to determine whether customers wanted a smaller, budget-friendly iPhone. However, Apple uses market intelligence all the time to monitor Samsung’s latest product releases, consumer demand for 5G phones, and shifts in smartphone pricing trends.

Why both are important: Market research provides deep insights into specific questions, while market intelligence ensures businesses have a constant pulse on their industry.

Key Types of Market Intelligence

Market intelligence is broad, covering multiple areas that help businesses stay competitive. To effectively gather market intelligence, companies need to focus on four main types: competitive intelligence, customer intelligence, market trends and industry insights, and product intelligence. Each provides a unique perspective, allowing businesses to make informed decisions based on real-time data.

Competitive Intelligence

Competitive intelligence involves monitoring competitors’ strategies, product changes, pricing, and customer engagement. This data helps businesses benchmark their performance, anticipate competitor moves, and identify market gaps.

How to Gather Competitive Intelligence:

- Track Competitor Websites & Marketing Materials – Analyze website updates, blog content, and promotional campaigns.

- Monitor Social Media & Ads – Use tools to track competitors’ social media campaigns and ad spend.

- Leverage Competitors App – Automate competitor tracking and monitor real-time updates on their pricing, new features, and marketing efforts.

Example:

If you’re an e-commerce retailer, you can use competitive intelligence to monitor how Amazon adjusts its product pricing and promotions. Tools like Competitors App can help you track when a competitor launches a discount campaign, giving you time to respond with a competitive offer.

Customer Intelligence

Customer intelligence focuses on understanding customer behaviors, needs, and sentiments. This data is crucial for businesses to develop personalized marketing strategies, improve customer satisfaction, and refine product offerings.

How to Gather Customer Intelligence:

- Conduct Surveys & Focus Groups – Directly ask customers about their preferences, challenges, and expectations.

- Use Social Listening Tools – Monitor social media discussions and online reviews to analyze brand perception.

- Analyze CRM & Support Data – Track customer interactions and feedback from your CRM or help desk software.

Example:

Streaming services like Netflix use customer intelligence by analyzing viewing habits to recommend content. They track how long users watch a show, when they pause, and what genres they prefer—allowing them to optimize content recommendations and decide which shows to renew or cancel.

Market Trends and Industry Insights

Market intelligence isn’t just about competitors and customers—it’s also about the bigger picture. Analyzing industry trends helps businesses stay ahead of regulatory changes, economic shifts, and technological advancements.

How to Gather Industry Insights:

- Subscribe to Industry Reports & Whitepapers – Follow reports from consulting firms like McKinsey, Gartner, and Deloitte.

- Monitor News & Government Reports – Stay updated on economic policies, regulatory changes, and emerging technologies.

- Attend Trade Shows & Networking Events – Gain first-hand insights from industry leaders and competitors.

Example:

Electric vehicle (EV) manufacturers like Tesla closely track government policies on EV subsidies. A reduction in subsidies in certain countries might affect Tesla’s pricing strategy, while new regulations on battery materials could influence its supply chain decisions.

Product Intelligence

Product intelligence involves tracking product performance, market demand, and competitors’ product innovations. This is essential for companies looking to improve existing products or develop new offerings that align with customer needs.

How to Gather Product Intelligence:

- Monitor Competitor Product Launches & Features – Keep track of new product updates, features, and discontinuations.

- Analyze Customer Feedback & Reviews – Identify pain points and gaps in competitor products to improve your offerings.

- Use Competitors App – Get real-time alerts when a competitor changes their product pricing, features, or descriptions.

Example:

If you’re a SaaS company, you need to track when HubSpot or Salesforce launches a new CRM feature. Using Competitors App, you can receive instant alerts about changes to their pricing, feature sets, or product descriptions—allowing you to adjust your own product roadmap or marketing strategy accordingly.

By leveraging these four key types of market intelligence, businesses can make data-driven decisions, refine their strategies, and maintain a competitive edge.

Step-by-Step Guide on How to Gather Market Intelligence

Collecting market intelligence effectively requires a structured approach. Instead of relying on scattered data, businesses should implement a step-by-step process to track competitors, understand customers, and stay ahead of industry trends. Below is a practical guide on how to gather market intelligence efficiently.

1. Set Up a Customer Feedback System

One of the most direct ways to gather market intelligence is by listening to your customers. Their feedback provides valuable insights into what they like, what frustrates them, and what they expect from your business.

How to Collect Customer Feedback:

- Surveys & Reviews – Use platforms like Google Reviews, Trustpilot, and Typeform to collect customer insights.

- Social Media Sentiment Analysis – Track conversations on Twitter, LinkedIn, and Facebook to analyze brand perception.

- Customer Support Interactions – Review helpdesk tickets, chat logs, and email responses to identify recurring issues.

Example:

E-commerce brands like Zappos actively monitor customer feedback on social media and reviews. If multiple customers complain about shipping delays, the company adjusts its logistics strategy to improve delivery speed.

2. Analyze Competitors and Current Market Trends

Keeping an eye on competitors is essential for staying competitive and identifying market gaps. Businesses should track their rivals’ pricing strategies, marketing efforts, and product changes.

How to Track Competitors & Market Trends:

- Monitor Competitor Websites & Social Media – Track their product updates, campaigns, and customer engagement.

- Follow Industry Reports & Trade Publications – Read reports from McKinsey, Statista, and IBISWorld to stay ahead of trends.

- Use Competitors App – Automate competitor tracking and receive real-time alerts about pricing changes, product updates, and marketing campaigns.

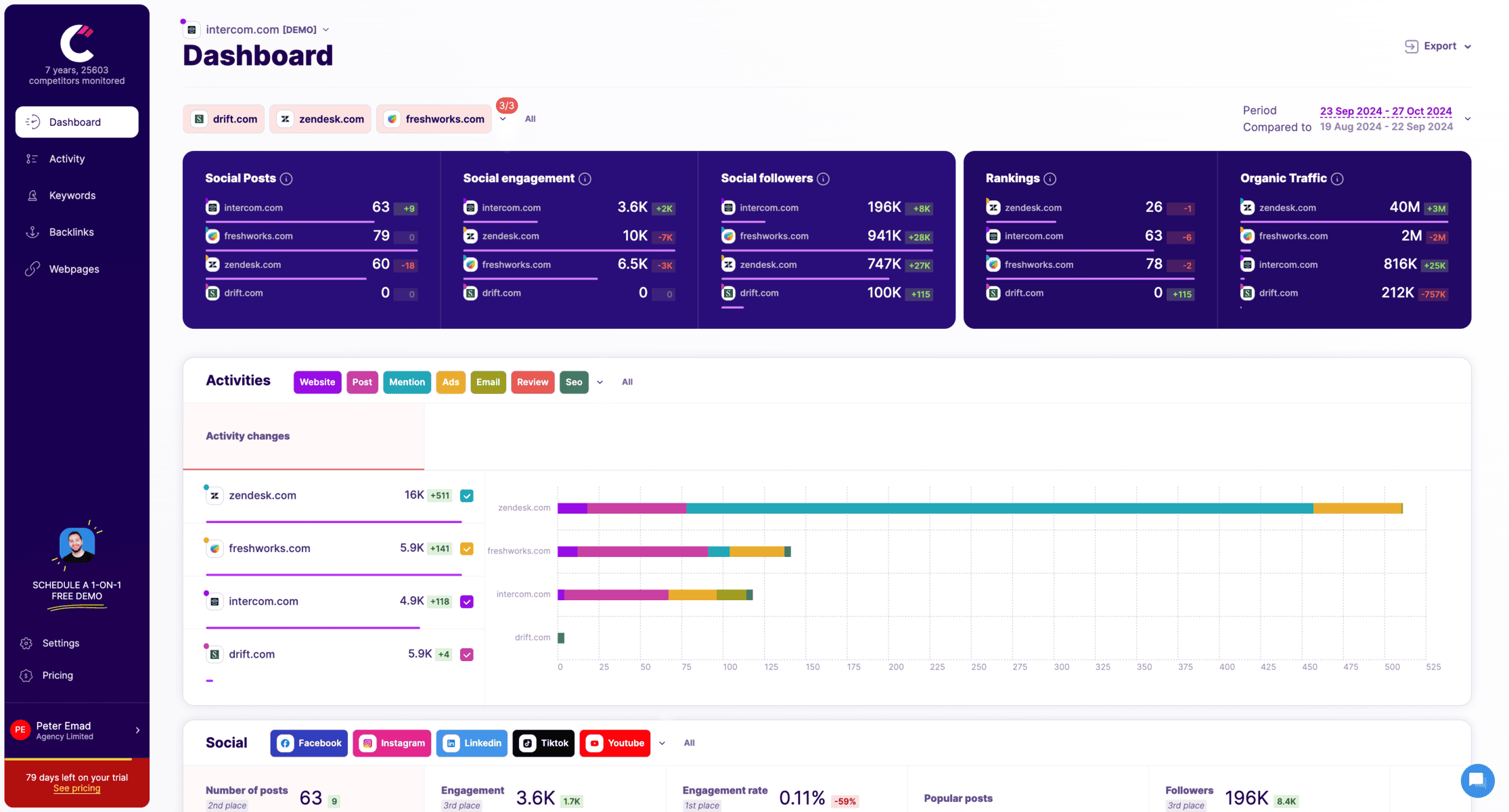

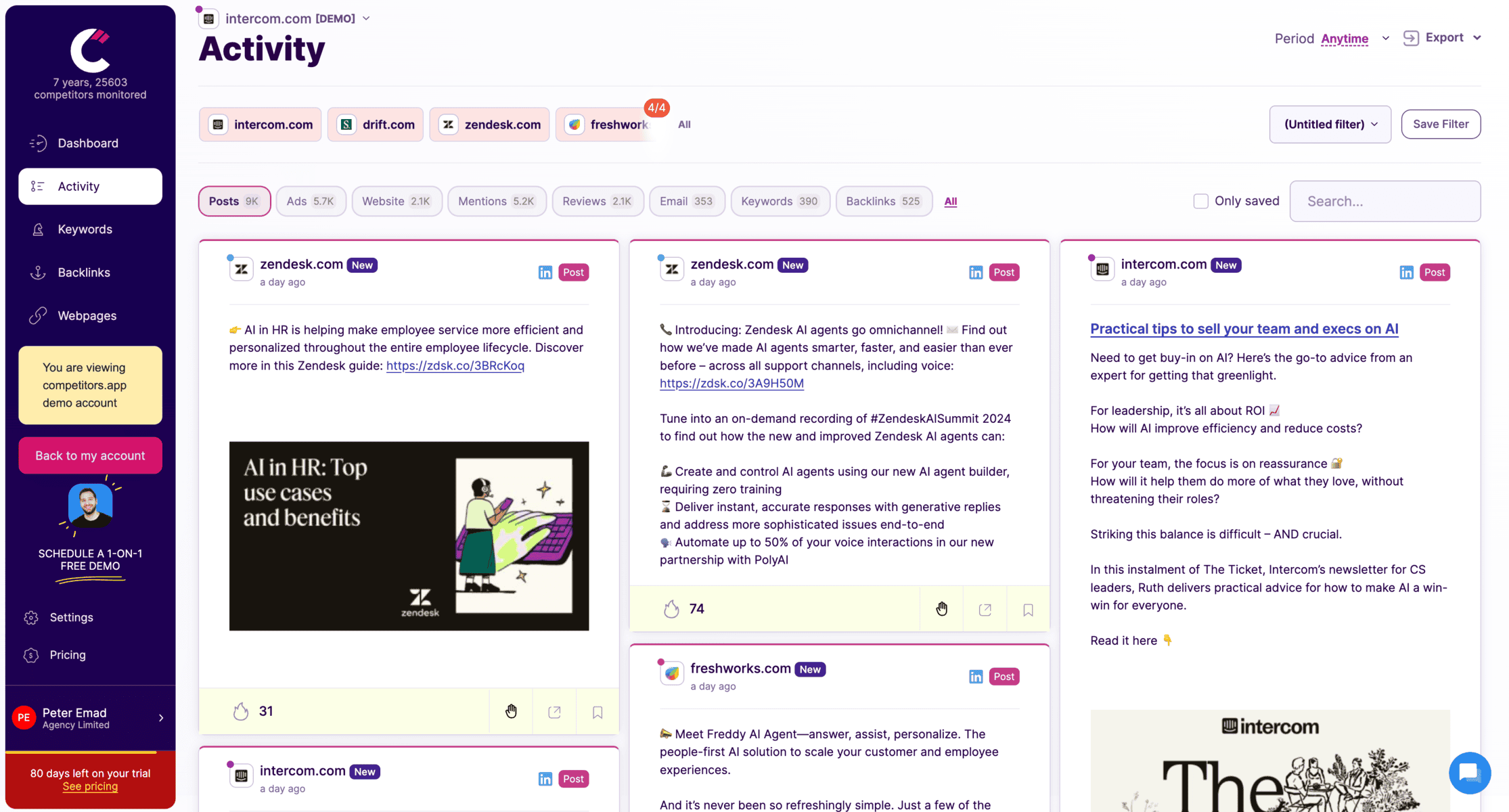

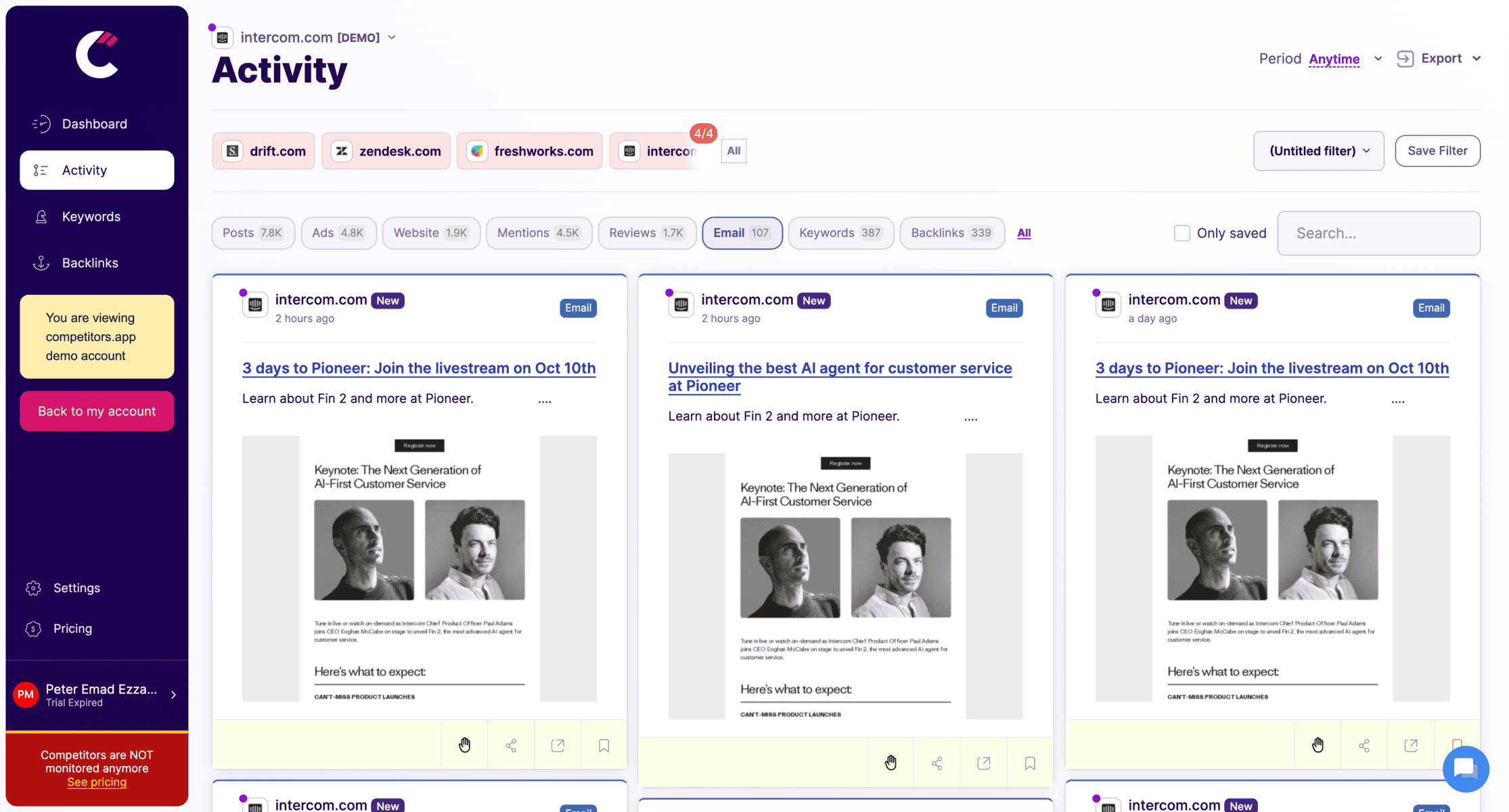

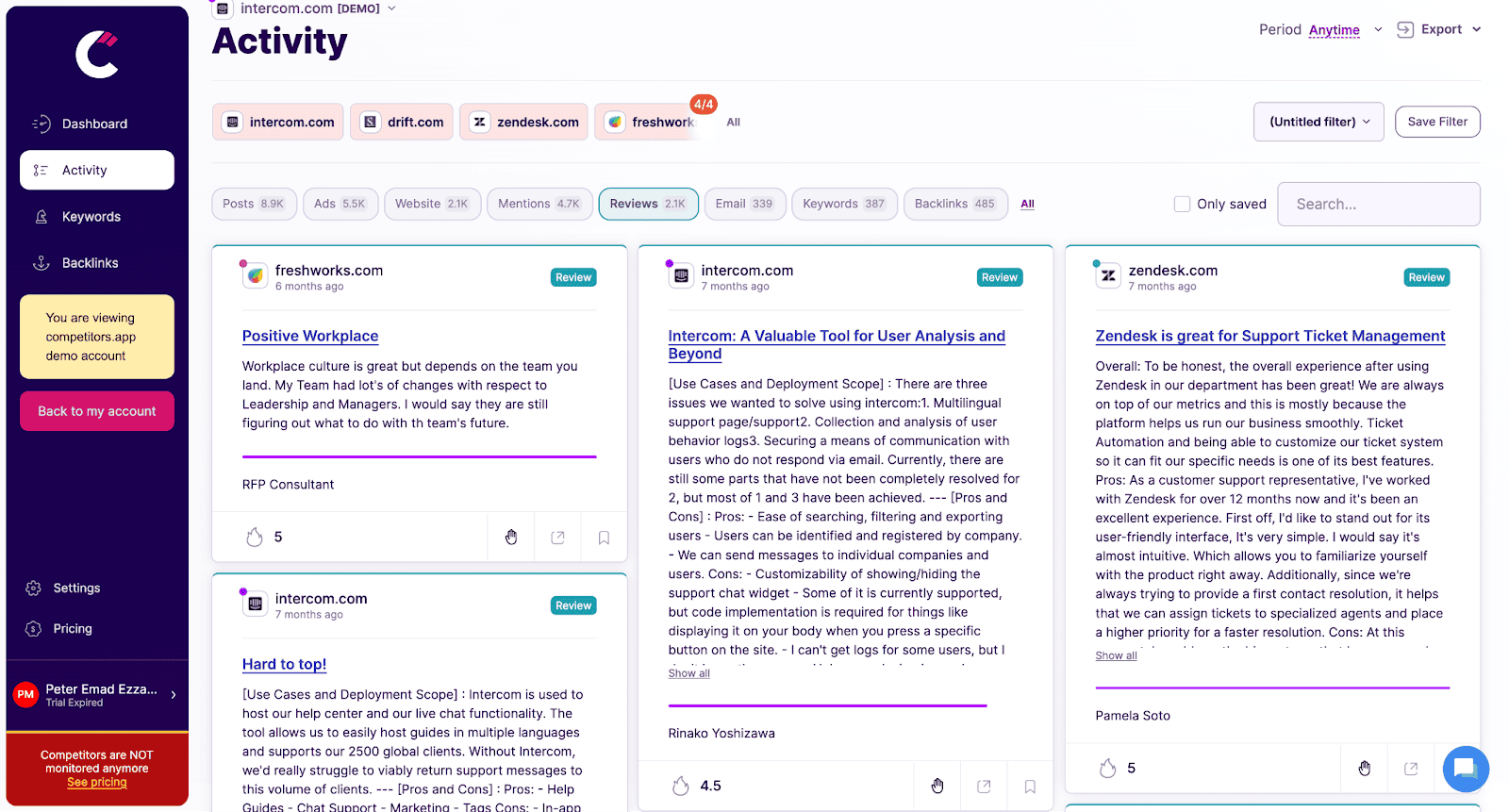

Competitors App (for Competitor Tracking and Marketing Insights)

Competitors App is designed for businesses that want to track their competitors’ marketing strategies, content performance, and digital activities. It provides insights into competitors’ SEO, ads, content marketing, and social engagement, helping businesses refine their own strategies.

Key Features:

- Tracks competitor website changes, ad campaigns, and content updates.

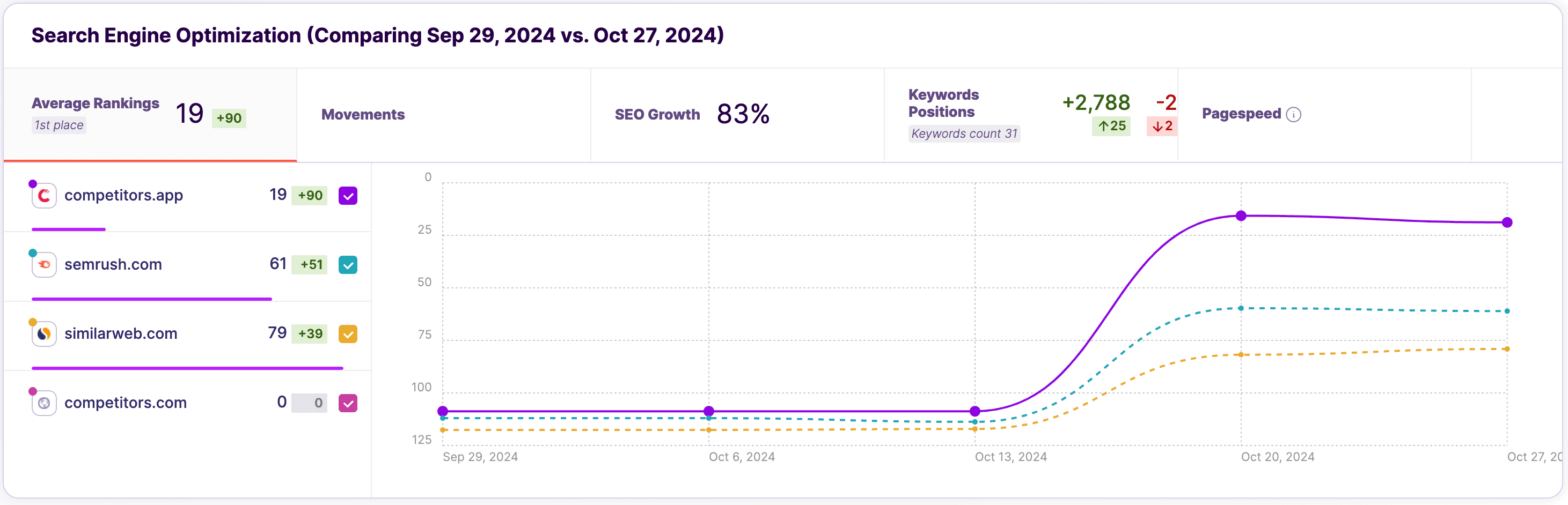

- Monitors keyword rankings and SEO trends over time.

- Provides alerts on competitor social media activity and engagement.

- Delivers competitive intelligence reports for benchmarking.

Tracks competitor social media updates across LinkedIn, Facebook, Twitter, and more.

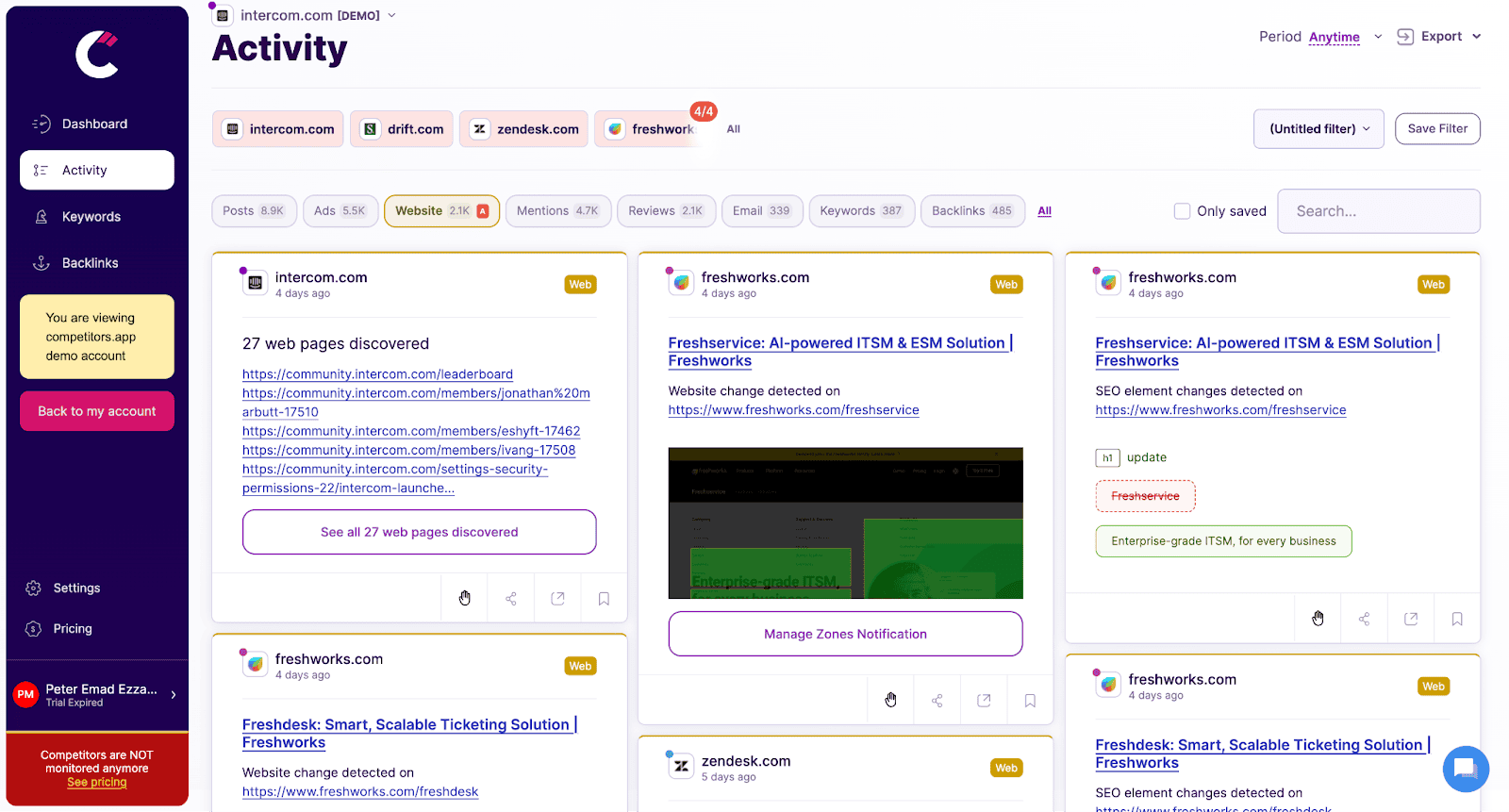

Monitors changes on competitors’ websites, such as product updates, pricing adjustments, and new messaging, providing instant alerts to help sales teams respond promptly.

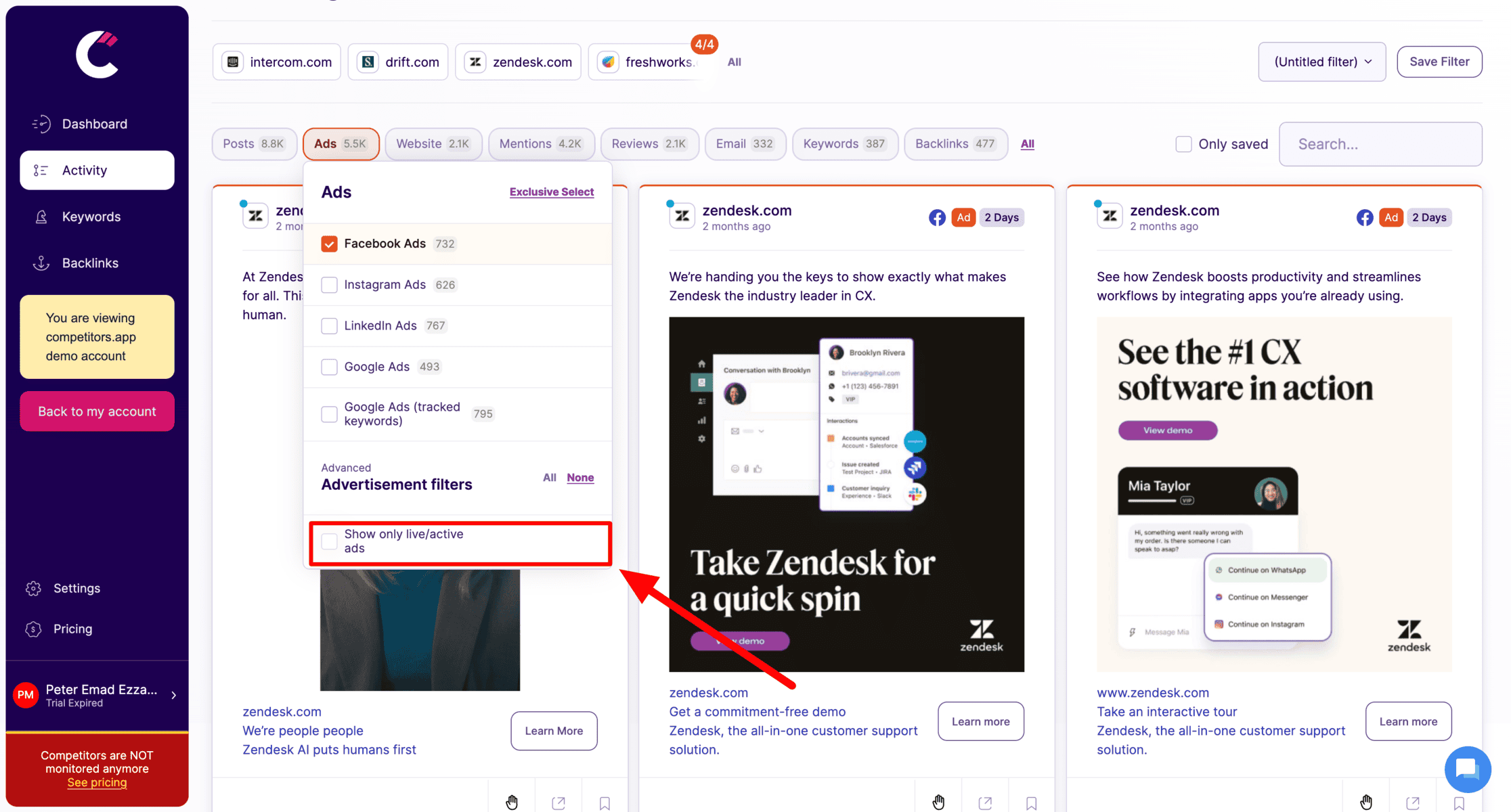

Tracks digital ad campaigns across platforms like Google Ads, Facebook, LinkedIn, and Instagram. It provides details on ad creatives, spending, and performance metrics, helping teams analyze successful ad strategies.

Analyzes competitors’ keyword strategies, organic rankings, and backlinks, allowing teams to refine their own SEO tactics and boost search visibility.

Tracks competitors’ email campaigns, including content, frequency, and engagement metrics, helping sales teams understand email tactics that drive engagement and conversions.

Analyzes customer reviews and ratings for competitors, providing insights into customer feedback, pain points, and product strengths, helping teams craft better sales pitches.

Example:

If you’re a software company, you might track HubSpot’s new CRM updates using Competitors App to see how they adjust pricing or introduce new features. This can help you fine-tune your own product strategy.

3. Develop Insights from SEO and Digital Marketing Data

SEO and digital marketing trends can provide deep insights into consumer demand, search behavior, and competitor strategies.

How to Use SEO for Market Intelligence:

- Track Competitors’ Keywords & Rankings – Use tools like Ahrefs, Semrush, or Google Search Console to analyze which keywords your competitors are ranking for.

- Analyze Content Performance – Identify which blog topics and landing pages drive the most traffic for competitors.

- Monitor PPC & Digital Ads – Track competitors’ paid ad campaigns to understand their targeting and messaging strategies.

Example:

A travel agency might notice that a competitor is ranking high for “best travel insurance for Europe” and generating strong engagement. By creating a more detailed and optimized article, they can compete for the same audience and gain more visibility.

4. Stay Updated with Industry News and Reports

Industry insights provide businesses with a macro-level understanding of market changes, economic shifts, and technological advancements.

How to Stay Informed:

- Subscribe to Market Research Firms – Reports from Gartner, Forrester, and IBISWorld provide valuable data on industry trends.

- Attend Industry Events & Webinars – Networking with experts can give real-time insights into emerging opportunities.

- Follow Government & Regulatory Reports – Changes in trade laws, taxation, or compliance can significantly impact business strategies.

Example:

A fintech startup might track regulatory updates on cryptocurrency laws to anticipate how future changes will impact its business model.

5. Leverage Publicly Available Data Sources

There’s a wealth of free market intelligence available if you know where to look.

Where to Find Free Market Intelligence Data:

- Government Reports & Economic Data – Check sources like World Bank, IMF, and national trade departments.

- Financial Filings & Earnings Reports – Public companies release quarterly reports that reveal market performance and future forecasts.

- User-Generated Content & Social Media – Online discussions, reviews, and forums can offer raw, unfiltered consumer sentiment.

Example:

Before launching a luxury fashion brand, a company might analyze financial reports from LVMH (Louis Vuitton) and Gucci to study growth trends and consumer spending habits in the high-end retail industry.

6. Track Purchase and Usage Data

Customer purchasing behavior provides a clear picture of market demand and product performance.

How to Track Buying Behavior:

- CRM Data & Customer Analytics – Track repeat purchases, churn rate, and average order value.

- E-commerce Sales Trends – Use platforms like Amazon Sales Rank, Shopify Analytics, or Google Trends to track product demand.

- Competitor Pricing & Discounts – Monitor how competitors adjust pricing, introduce bundles, or offer seasonal promotions.

Example:

A SaaS company might analyze customer churn rates and find that users are dropping off due to pricing concerns. By adjusting the pricing model or offering tiered plans, they can improve retention.

7. Utilize Social Media Monitoring

Social media platforms are goldmines of real-time consumer sentiment, competitor activity, and industry trends.

How to Monitor Social Media for Market Intelligence:

- Track Brand Mentions & Hashtags – Use tools like Brandwatch or Sprout Social to analyze consumer conversations.

- Monitor Competitor Engagement – Identify what type of content gets the most engagement for competitors.

- Follow Influencer & Community Discussions – Platforms like Reddit, Twitter, and LinkedIn often reveal early-stage market trends.

Example:

A fitness brand might discover a rising trend in plant-based protein powders by analyzing fitness influencers’ posts on Instagram and TikTok. This insight could influence future product development.

How to Automate Market Intelligence Collection

Manually gathering market intelligence is time-consuming, and businesses risk missing critical updates. Automating the process allows for real-time insights, improved accuracy, and better decision-making without the need for constant manual tracking.

Benefits of Automation:

- Saves Time – No need to track competitors, trends, or customer sentiment manually.

- Real-Time Alerts – Get notified instantly when competitors adjust pricing, launch new products, or shift strategies.

- Scalable & Accurate – AI-driven tools analyze large datasets quickly, reducing human error.

Best Tools for Automated Market Intelligence:

- Competitors App – Monitors competitor website updates, SEO changes, customer reviews, competitor emails, and ad campaigns.

- Brandwatch – Tracks social media mentions and sentiment trends.

- Google Alerts – Sends notifications when competitor brands or key topics are mentioned online.

- Semrush – Provides insights on SEO, PPC ads, and keyword tracking.

By integrating AI-powered analytics and automation tools, businesses can collect and analyze market intelligence effortlessly, allowing them to focus on strategy rather than data gathering.

How to Use Market Intelligence for Business Growth

Market intelligence is only valuable when it translates into actionable business improvements. By leveraging data on competitors, customers, and industry trends, businesses can make informed decisions that drive growth, efficiency, and competitive advantage.

Guiding Strategy and Decision-Making

Using market intelligence, businesses can identify opportunities, mitigate risks, and adjust their strategic direction. Whether it’s entering a new market, repositioning a brand, or adjusting pricing models, data-driven decisions reduce uncertainty and increase the chances of success.

Enhancing Product Development

Analyzing market trends and customer feedback helps businesses refine existing products or develop new ones that align with demand. Tracking competitor innovations and industry shifts ensures that businesses remain competitive and avoid falling behind.

Improving Marketing and Sales Strategies

Market intelligence allows businesses to optimize advertising, content, and pricing strategies by understanding what resonates with their target audience. Studying competitor campaigns, consumer search behavior, and social media engagement helps brands refine their approach and maximize ROI.

Strengthening Customer Relationships

Understanding customer sentiment through reviews, social media, and direct feedback enables businesses to improve customer service, personalize marketing, and increase loyalty. A business that listens to its customers and adapts accordingly builds stronger, long-term relationships.

By integrating market intelligence into every aspect of business operations, companies can stay ahead of competitors, anticipate market shifts, and drive sustainable growth.

Frequently Asked Questions (FAQ)

What is market intelligence, and why is it important?

Market intelligence is the process of collecting and analyzing data about competitors, customers, and industry trends to make informed business decisions. It helps businesses stay competitive, predict market changes, and refine their strategies based on real-world insights rather than assumptions.

How do I gather market intelligence for my business?

You can gather market intelligence using various methods, including:

- Customer feedback – Conduct surveys, monitor reviews, and track social media sentiment.

- Competitor analysis – Use tools like Competitors App to track website changes, pricing updates, and marketing strategies.

- SEO and digital marketing insights – Monitor search trends and analyze competitor keywords.

- Industry reports and publicly available data – Stay updated on market trends through government reports, financial filings, and trade publications.

- Social media monitoring – Track brand mentions and competitor engagement for real-time insights.

What are the main sources of market intelligence?

Market intelligence can be sourced from:

- Competitor websites and marketing materials

- Customer feedback and online reviews

- SEO and digital marketing data

- Industry reports and government publications

- Social media conversations and trends

- Internal company data from CRM systems

What is the difference between market intelligence and marketing intelligence?

Market intelligence covers broader industry insights, including competitor analysis, customer trends, and regulatory changes. Marketing intelligence, on the other hand, focuses specifically on marketing performance metrics such as ad effectiveness, customer acquisition, and campaign ROI.

How often should I update my market intelligence strategy?

Market intelligence should be an ongoing process. Businesses should track competitors and industry trends in real-time and conduct in-depth analysis quarterly to refine their strategy based on new insights.

What are common mistakes to avoid when gathering market intelligence?

- Relying on outdated or limited data sources – Real-time insights are crucial for accuracy.

- Ignoring qualitative insights – Customer feedback and social sentiment are just as important as numbers.

- Failing to analyze competitors consistently – Sporadic tracking leads to missed opportunities.

- Overcomplicating data collection – Gathering intelligence should lead to actionable insights, not just excessive data.