Crafting a Winning Competitive Intelligence Report [+ Template]

Table of Contents

Has your manager or CEO ever asked you about the competition? Well, there’s a good reason for that. Competition is fiercer than ever, with companies constantly battling for market share and customer loyalty. To navigate this challenging landscape, you need more than just a strong product or service; you need a deep understanding of your competitors. That’s where competitive intelligence reports come into play, offering critical insights to shape your business strategy and keep you ahead of the game.

What is a Competitive Intelligence Report?

The definition of a competitive intelligence report is s document that helps you understand your competitors moves, but it’s more than that. When we talk about a competitive intelligence report, we’re referring to a comprehensive document that outlines your competitors’ activities, market behavior, and business strategies. Unlike other business reports that might focus solely on internal metrics or industry benchmarks, a competitive intelligence report aims to give you a 360-degree view of your competitive landscape. It’s a crucial tool for making informed decisions and crafting strategies that give you a leg up on the competition.

The Importance of Competitive Intelligence Reports

Understanding your competition is not just a nice-to-have; it’s a must-have in today’s business world. A well-structured competitive intelligence report can be a goldmine of insights. It helps you understand market trends, identify business risks, and discover opportunities that you may not have been aware of. More importantly, it equips you with the knowledge to make decisions that could give you a competitive edge.

Real Life Story A: How a Competitive Intelligence Report created a winning marketing strategy

For instance, one of our clients, a popular course-making website, used Competitors App to identify a gap in their competitors’ refund policies. They capitalized on this by running ads against their competitors’ refund policy pages, gaining valuable traffic and a significant competitive edge.

Real Life Story B: How a Competitive Intelligence Report identified a market gap

Another example comes from a local orthodontist, also a client of Competitors App. He discovered that none of his local competitors were investing in SEO. By focusing on SEO and customer reviews, he was able to rank first among his competitors, driving valuable traffic and acquiring new customers.

The Purpose of Crafting a Competitor Intelligence Report

The primary aim of a competitive intelligence report is to provide actionable insights that inform your business strategy. It’s not just about collecting data; it’s about interpreting that data to understand market trends, identify opportunities, and make informed decisions. Whether you’re looking to enter a new market, launch a new product, or simply outperform your competitors, a well-crafted report serves as a strategic guide. It helps you understand not just where your competitors are now, but where they’re likely headed in the future, giving you the foresight to plan accordingly.

Here are some purposes that a competitive intelligence report serves:

here’s how a competitive intelligence report serves multiple purposes, broken down into bullet points:

Informed Decision-Making: Helps in making strategic business choices based on real data, reducing the risk of costly errors. By having an oversight of your competitor moves, errors can be avoided and marketing budget can be spent only on what matters most.

Accelerated Learning Curve: Allows you to learn from your competitors’ successes and failures, effectively shortening your own learning curve in the market. For example you can do social media monitoring to see what are the posts that engage your competitors audience.

Problem Identification: Surfaces issues that competitors are facing, which can be turned into opportunities for your business. By checking your competitors PR news for example you can understand funding issues that they might be having or potential threats that they have such as a bad partnership deal. All these can help you not only gain competitive advantage but also avoid similar problems.

Product Roadmap Guidance: Insights from the report can directly inform your product development strategy, helping you prioritize features or services that will give you a competitive edge. You can find these by analyzing your competitors reviews or mentions on Social Media or the Web.

Sales Enablement: The data can be used to create sales battle cards, providing your sales teams with the ammunition they need to outperform competitors.

The process for Creating a Competitive Intelligence Report in 9 Steps

Step 1: Setting Objectives

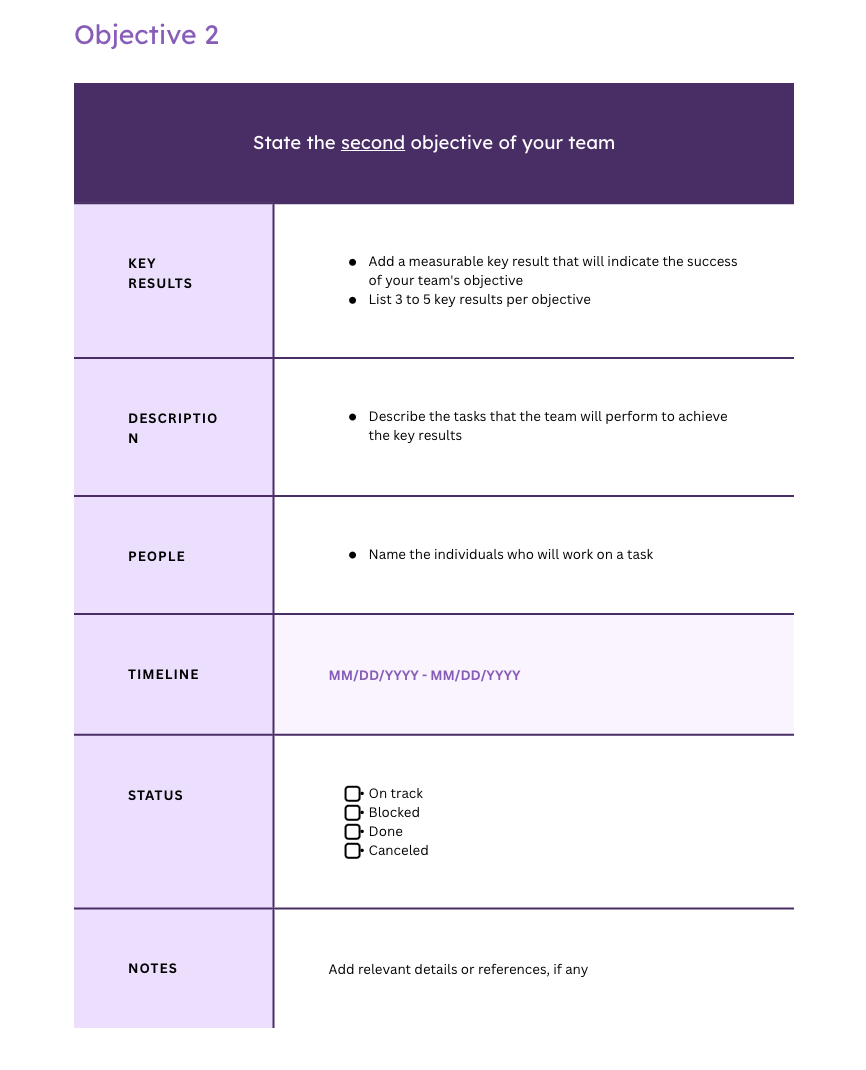

Setting objectives for your competitive intelligence report is crucial for guiding your research and analysis. Start by asking questions like, "What specific insights are we looking to gain?" or "Who will use these information?" Objectives could range from understanding a competitor's customer acquisition strategies to identifying market trends that could impact your business. Once you've set your objectives, make sure to communicate them clearly to all key stakeholders involved. This ensures that everyone is on the same page and sets the stage for a more focused and effective research process. Once you've completed these steps then you are ready to draft your research plan.

Step 2: Set Key Performance Metrics

Identifying the right key performance metrics (KPIs) is essential for measuring the success of your competitive intelligence efforts. These could include metrics like market share, customer retention rates, or website traffic. The KPIs you choose should align with the objectives you've set for the report. For example, if one of your objectives is to understand your competitors' digital marketing strategies, metrics like website bounce rate or social media engagement could be relevant. Tracking these KPIs over time will not only help you gauge the effectiveness of your own strategies but also give you a clearer picture of your competitors' performance.

Step 3: Preparing for Competitive Intelligence Gathering

Before diving into data collection, it's crucial to prepare adequately. This involves identifying the data sources you'll use, the competitor analysis tools needed for data gathering, and the team members who will be responsible for this task. Preparation also includes setting up a system for data storage and analysis. For instance, you might use a tool like Competitors App to track your competitors' activities in real-time, which can be particularly useful for dynamic industries where things change rapidly.

Step 4: Defining Your Competitive Landscape

In this step, you'll focus on understanding who your competitors are and how they operate. Here's how to go about it:

Competitor Profiling: Create detailed profiles for each key competitor, outlining their products, strategies, and market presence. This will help you understand what you're up against.

Types of Competitors: Identify whether your competitors are direct, indirect, or substitute competitors. Each type requires a different strategic approach.

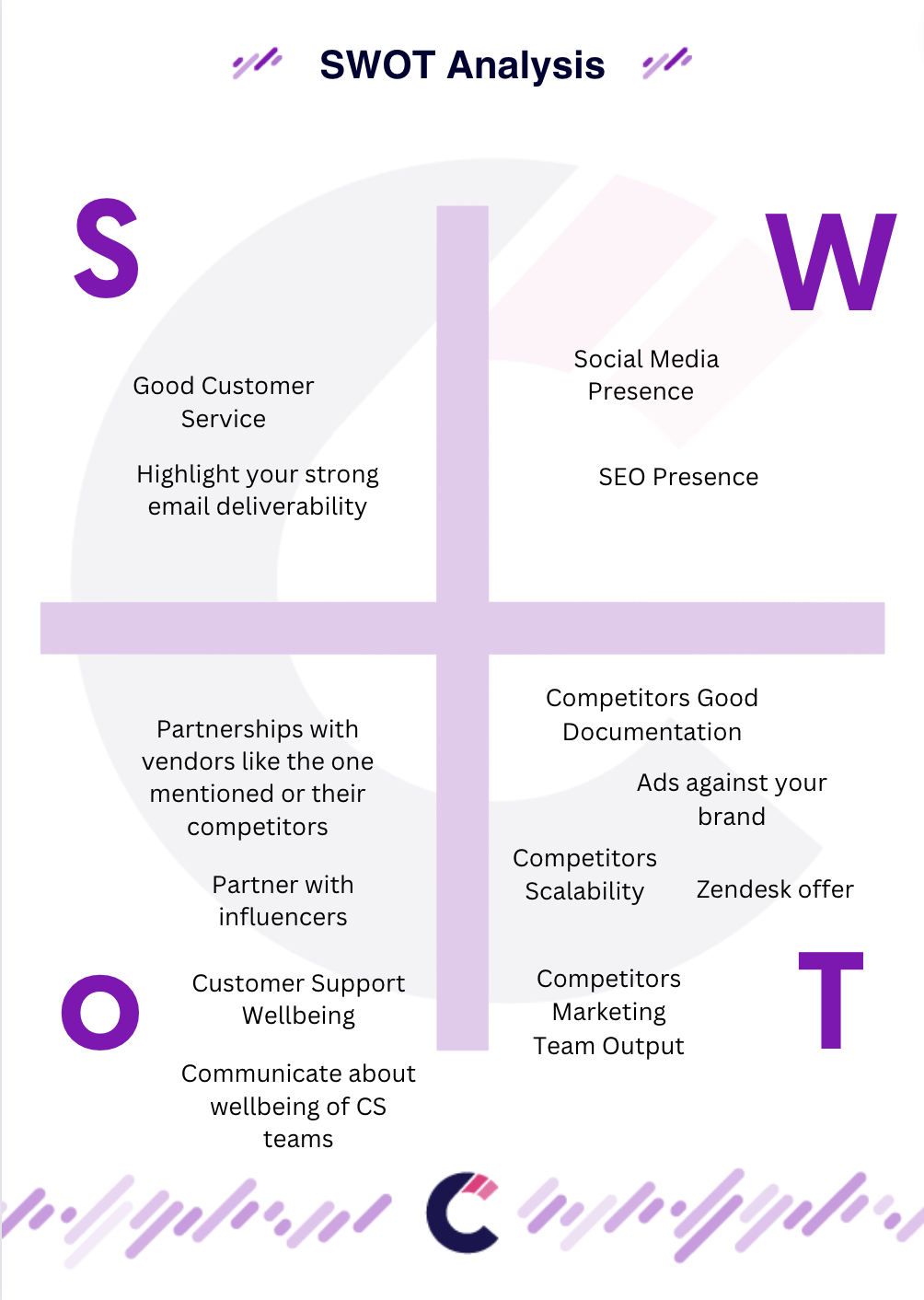

SWOT Analysis: Conduct a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis for each competitor to understand their strategic positioning.

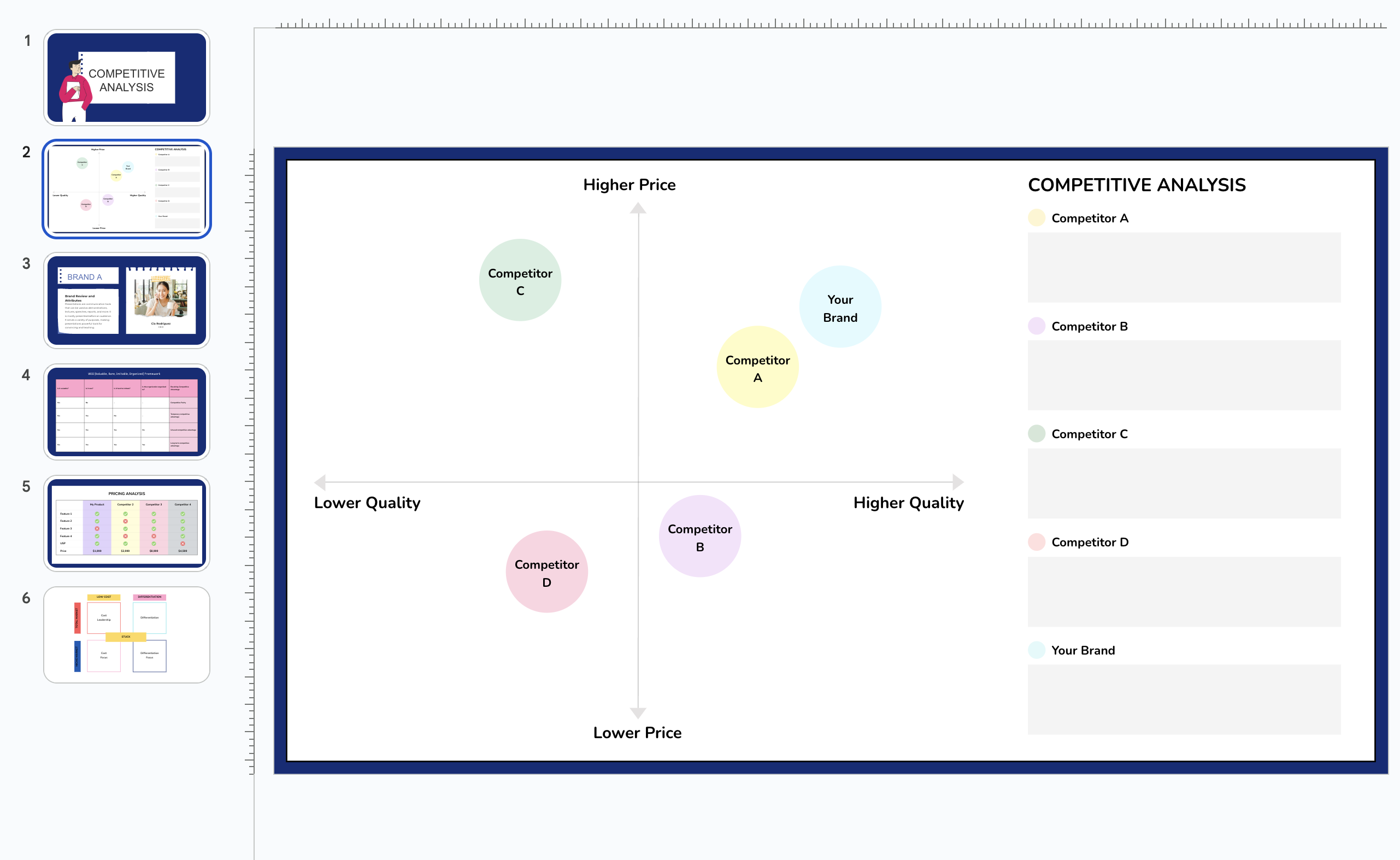

Competitor Analysis XY Matrix: Use an XY matrix to plot competitors based on various factors like market share and product quality. This visual tool can help you perform a competitor analysis and quickly assess your competitive landscape.

Competitor Positioning and Market Share: Understand where your competitors stand in the market. Are they leaders, challengers, followers, or nichers? Knowing this will help you identify gaps and opportunities.

By completing this step, you'll have a comprehensive view of your competitive landscape, which is essential for crafting an effective competitive intelligence report.

Step 5: Perform Industry Analysis and Find Market Trends

After defining your competitive landscape, the next crucial step is to analyze the industry and market trends. This will provide you with a broader context within which your competitors operate, allowing for a more comprehensive analysis. Make sure to understand about everything from regulatory changes and emerging technologies to shifts in consumer behaviour. A thorough market analysis can help you identify new opportunities that your competitors haven't tapped into yet, as well as potential threats that could impact your market share. Tools like PESTLE analysis can be useful here.

Step 6: Gathering Data: Sources and Techniques

Before diving into the analysis, you'll need to gather the data that will fuel your insights. This is a critical step in the competitive intelligence process, and it's important to be thorough and systematic.

Primary and Secondary Data Sources: Utilize both primary sources like customer interviews, surveys, and direct observations, as well as secondary sources such as industry reports, academic journals, and competitor websites.

Tools for Data Gathering: Consider using specialized competitive intelligence tools to automate some of this data collection. For instance, a tool like Competitors App can track your competitors' activities and provide you with real-time insights.

Data Validation: Ensure the data you collect is accurate and up-to-date. Cross-reference information from multiple sources when possible to validate its reliability.

By meticulously gathering data, you set the stage for a more in-depth and accurate analysis, making your competitive intelligence report a robust tool for strategic planning.

Step 7: Data Analysis - Analyzing and Organizing Information

After gathering your data, the next step is to analyze and organize it to turn raw information into actionable insights. This involves using various data analysis techniques like trend analysis, correlation studies, and even advanced statistical models. For example, you might use a SWOT analysis to categorize your findings into strengths, weaknesses, opportunities, and threats. The goal is to interpret the data in a way that informs your business strategy and provides a clear path for decision-making.

Step 8: Create & Present your Competitive Intelligence Report (Powerpoint or PDF)

Once you've analyzed the data, the next step is to compile it into a comprehensive competitive intelligence report. This report should be structured in a way that makes it easy for key stakeholders to understand the findings and take action. Use visuals like charts and graphs to represent data and make complex information easily digestible. The report should also include an executive summary, competitor profiles, market trends, and actionable insights & recommendations. Read here about more types of competitive analysis reports. This document serves as the final output of your competitive intelligence efforts and is crucial for informed decision-making.

CI Report Structure and Format

When it comes to crafting a competitive intelligence report, the structure and format are crucial for effective communication. A well-organized report not only makes the data more digestible but also aids in quicker decision-making. Below are some guidelines and specific examples to consider when structuring your report.

Structure: Start with an executive summary and follow with sections like competitor profiles, SWOT analysis, market trends, and actionable insights. For example, you could structure your report with these headings:

- Executive Summary

- Introduction

- Competitor Profiles

- SWOT Analysis

- Market Trends

- Actionable Insights

- Conclusion

Visual Aids: Use charts to display market share comparisons, graphs for trend analysis, and tables for side-by-side competitor features. For instance, a pie chart could illustrate your market share relative to competitors, while a line graph could track price changes over time.

Conciseness: Keep text brief but informative. Use bullet points or numbered lists to break down complex information. For example, instead of a long paragraph about a competitor’s features, use a bullet-point list to quickly convey the information.

Reader-Friendly: Use headings, subheadings, and even color coding to make the report easy to navigate. For example, you could use different colors for each section or for critical vs. non-critical data points.

Examples: Whenever possible, include real-world examples to support your data. For instance, if you’re discussing a competitor’s failed marketing campaign, include specific figures showing the decline in their customer engagement.

The goal is to make the report as accessible and useful as possible for quick decision-making.

Key Components of a Competitive Intelligence Report

The backbone of a compelling competitive intelligence report lies in its key components. Each section serves a unique function and collectively contributes to informed decision-making. Below are the essential elements you should include, along with the specific roles they play in the report.”

Executive Summary: This is a concise overview of the report’s findings, designed to give decision-makers a quick snapshot of the competitive landscape. It sets the stage for the detailed analysis that follows.

Competitor Profiles: This section provides in-depth information about your competitors, including their market positioning, product offerings, and marketing strategies. It serves as the foundation for industry analysis, helping you understand where you stand in relation to your competitors.

SWOT Analysis: This part is crucial for assessing the strengths, weaknesses, opportunities, and threats for both your company and your competitors. It offers a balanced view that aids in strategic planning.

Market Trends Analysis: This section identifies both current and future market trends. Understanding these trends is vital for anticipating market shifts and making timely decisions.

Actionable Insights & Recommendations: This is perhaps the most critical section, as it translates all the data and analysis into actionable strategies and tactics. It provides a roadmap for future actions and includes examples of strategic recommendations based on the report’s findings.

By including these key components, you ensure that your competitive intelligence report is not just a collection of data, but a strategic tool that can guide decision-making processes.

How to turn CI Data into Actionable Insights

Often considered the most challenging yet crucial part of a competitive intelligence report, this section demands your utmost attention. It’s where you transform raw data into strategic actions that can significantly impact your business. Here’s how to make this section as effective as possible:

Prioritize Findings: Not all data points are equally important. Start by identifying the most impactful insights that align with your business objectives.

Correlate Data: Look for patterns or correlations between different pieces of data. For example, if you notice a competitor’s increased social media activity correlates with a spike in their sales, that’s an actionable insight.

Consult Stakeholders: Before finalizing your recommendations, consult with key stakeholders to ensure the insights align with broader business goals.

Be Specific: Vague recommendations are hard to act upon. Be as specific as possible. Instead of saying “Improve online presence,” say “Increase LinkedIn posts to three times a week to match Competitor X’s frequency.”

Assign Responsibility: Make it clear who is responsible for implementing each recommendation and set deadlines.

Measure and Adjust: Include key performance indicators (KPIs) to measure the effectiveness of the implemented actions. Be prepared to adjust your strategies based on these metrics.

Download the Ultimate Template for an efficient Competitive Intelligence Report (PowerPoint or PDF)

Ready to take your competitive intelligence to the next level? We’ve created an all-inclusive, easy-to-use template that covers all the key components of an effective Competitive Intelligence Report. From setting objectives to actionable insights, our template has got you covered.

Why Download Our Template?

✅ Streamlined Structure: Our template follows a logical flow, making it easier for you to input your data and insights.

✅ Customizable: Tailor the template to fit your specific industry and business needs.

✅ Time-Saving: Why start from scratch when you can use a template that’s already been optimized for success?

By using our template, you’ll save time, ensure you’re not missing any critical components, and produce a report that’s both comprehensive and actionable.

#1 Tool To Create a Customer Intelligence Report

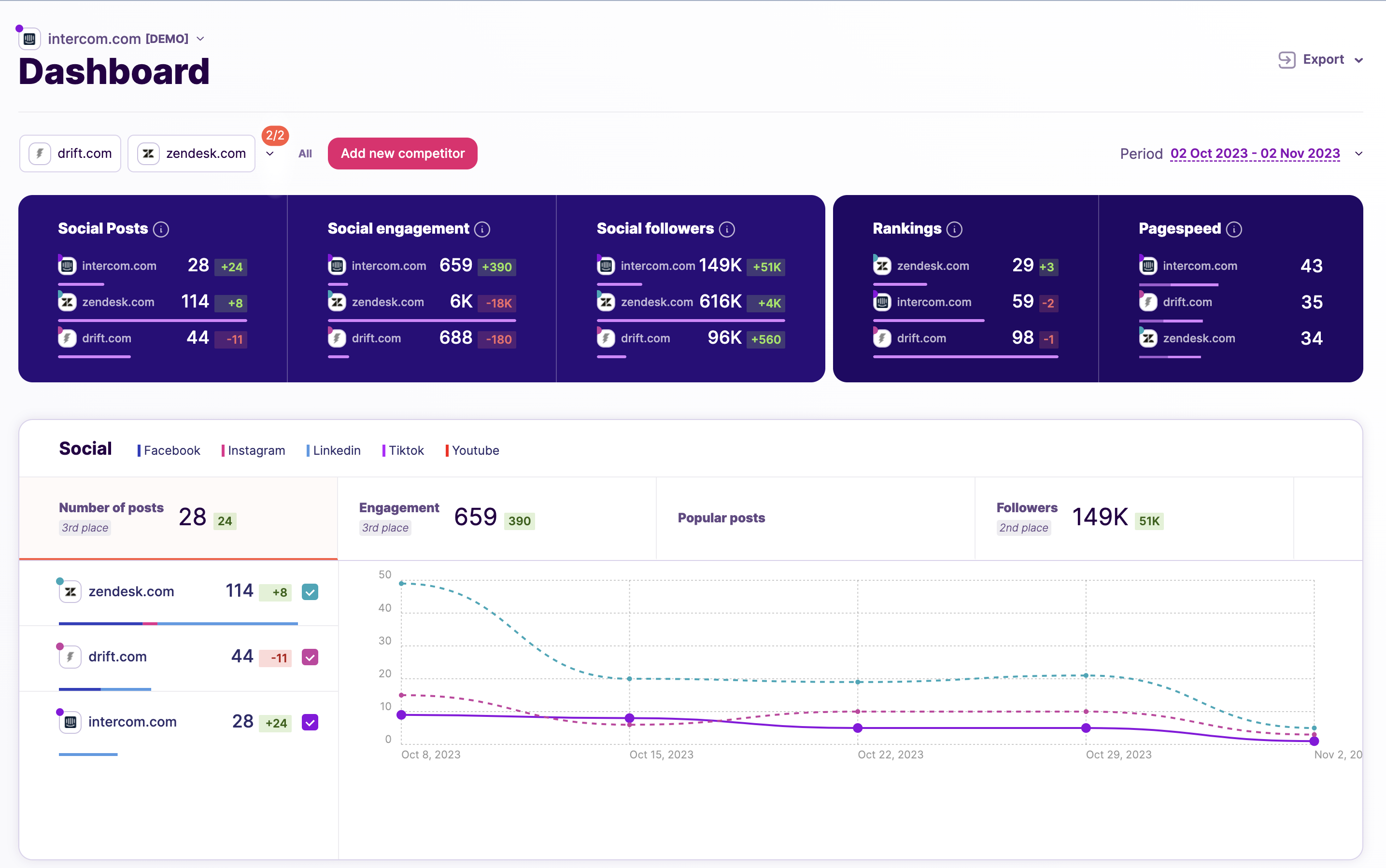

When it comes to crafting a comprehensive and actionable Competitive Intelligence Report doing it with a tool is always easier. Competitors App stands out as the go-to competitive intelligence software. Here’s why you should consider using Competitors App for your next CI report.

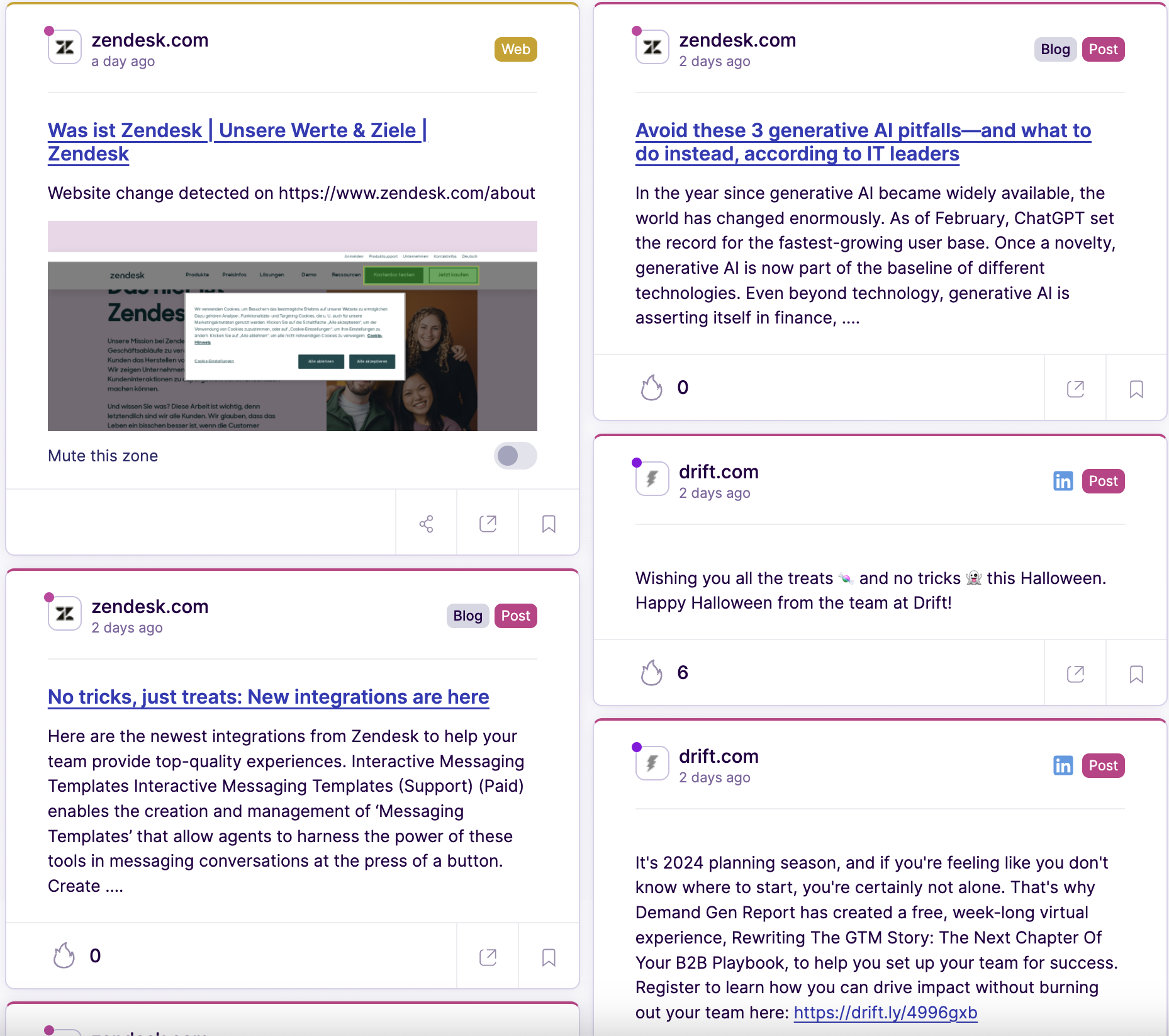

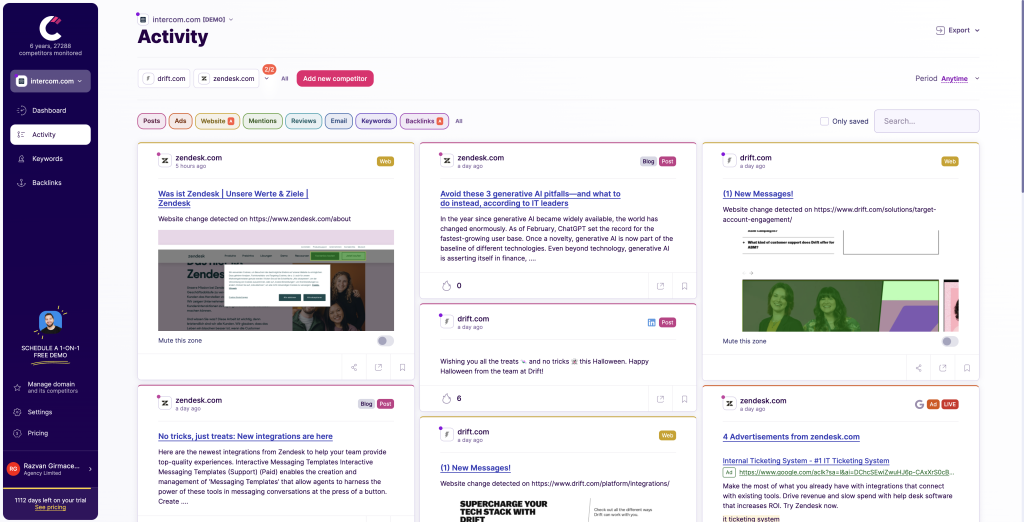

Real-Time Monitoring

Get instant updates on your competitors’ activities, from social media posts to website changes.

Multi-Channel Tracking

Competitors App allows you to track a wide range of channels including social media, email marketing, SEO, and even website changes. This ensures you have a 360-degree view of your competitors’ activities.

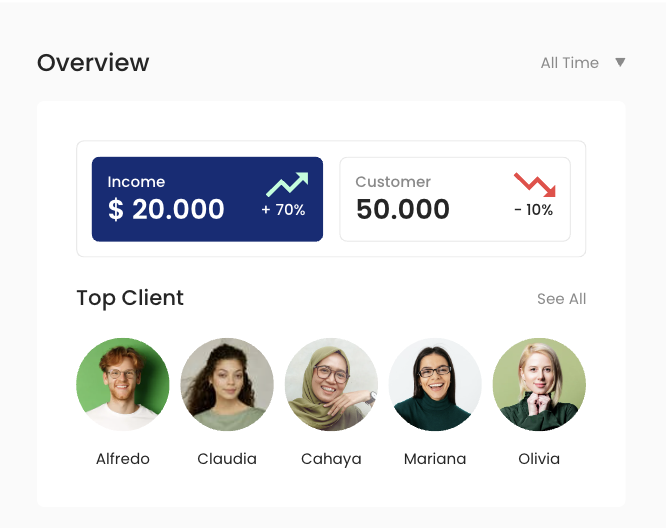

Easy-to-Use Dashboard

The user-friendly dashboard aggregates all the data in one place, making it easier for you to analyze and make informed decisions.

Time-Saving

Automated tracking and reporting features save you the time you would otherwise spend manually gathering data, allowing you to focus on strategy and execution.

Smart Email Notifications

One of the standout features of Competitors App is its email notification system. You can set up custom alerts for specific competitor activities or metrics that are crucial for your business. This means you’re always in the loop and can act quickly, without having to constantly check the dashboard.

Examples of a Competitive Intelligence Report

Understanding the theory behind competitive intelligence is one thing, but seeing it in action can provide a whole new level of insight. Here are some examples of how different departments within a company can benefit from tailored competitive intelligence reports:

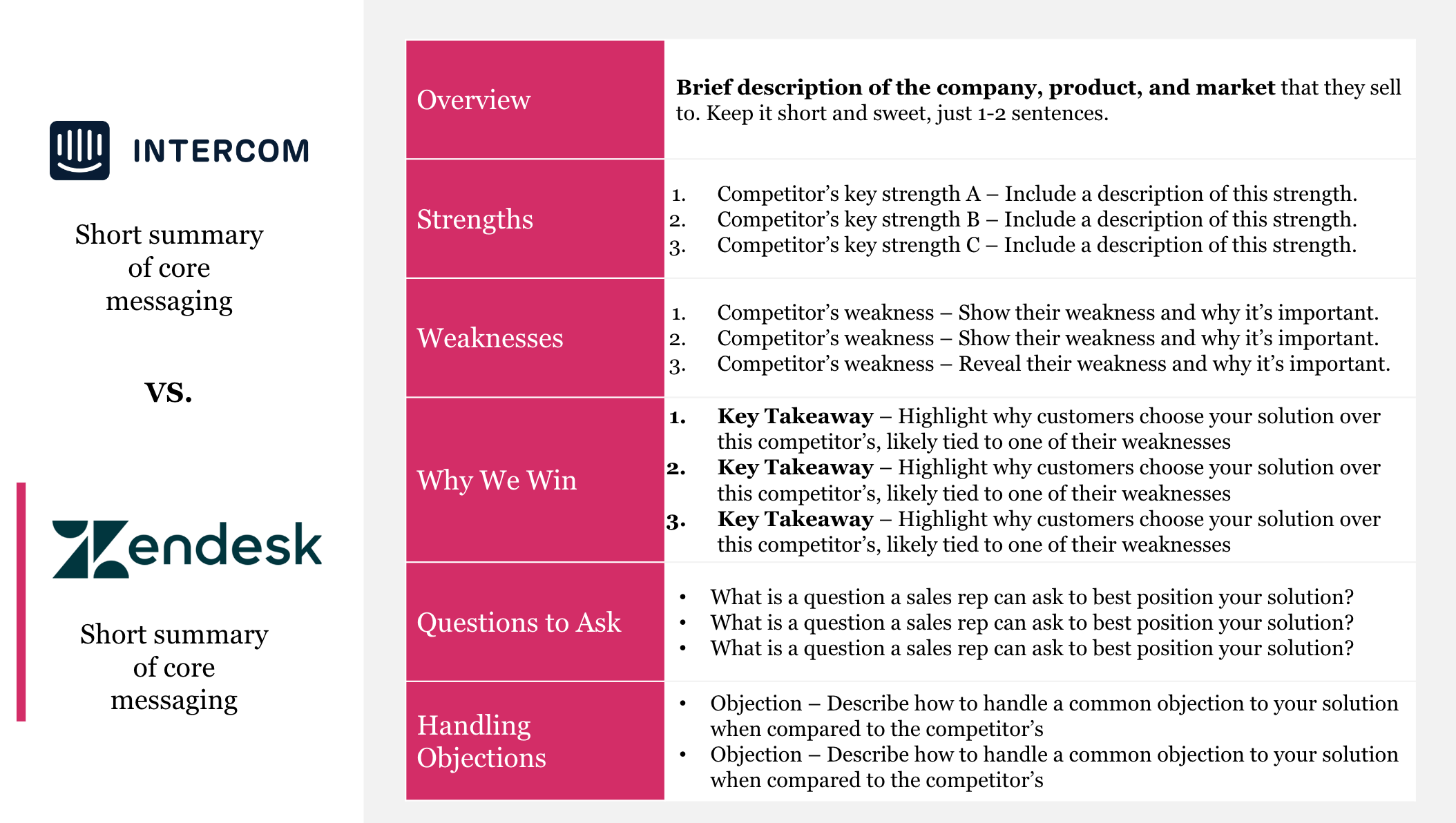

Competitive Intelligence Reports for Sales Teams

Sales teams can use competitive intelligence reports to understand the pricing strategies, sales channels, and customer reviews of competitors. This information can be invaluable for crafting more effective sales pitches and for identifying new market opportunities. In the sales world you will meet the term sales battlecards that refer as an actionable document that derives from competitive reports.

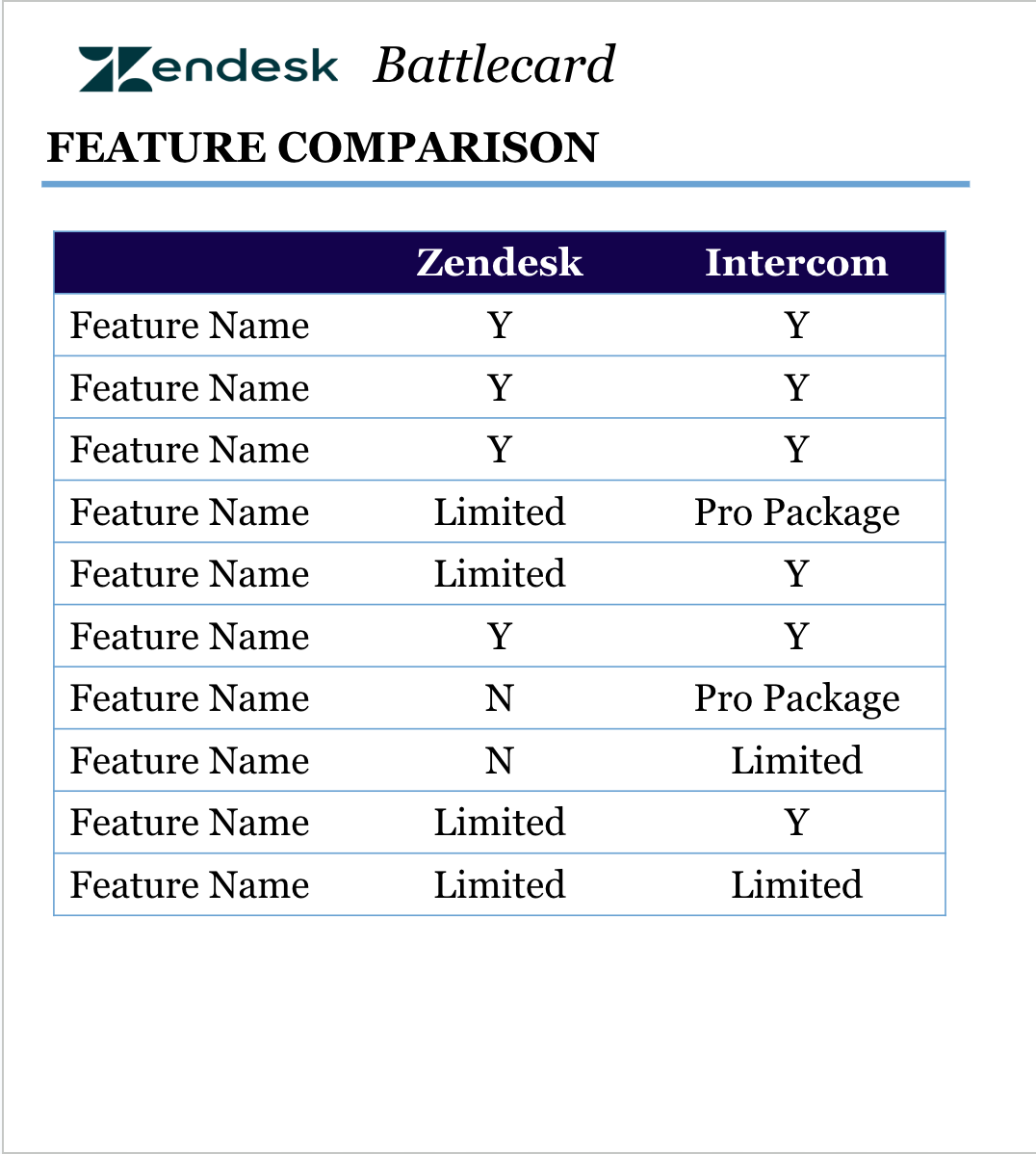

Competitive Intelligence Data for Product Teams

A competitive intelligence report can be a game-changer for product teams. It allows for a deep dive into feature comparisons, helping to identify gaps or advantages in your own product. Insights into competitors' user experience can guide your UX design choices. Additionally, knowing about upcoming product launches from competitors can help you strategically time your own releases, giving you a competitive edge. Being aware of your competitors' upcoming launches can also help you identify potential partnerships or marketing angles to explore. This proactive approach can position your product more favorably in the market. Overall, a well-crafted competitive intelligence report serves as a valuable roadmap for product teams, steering them towards informed and strategic decisions.

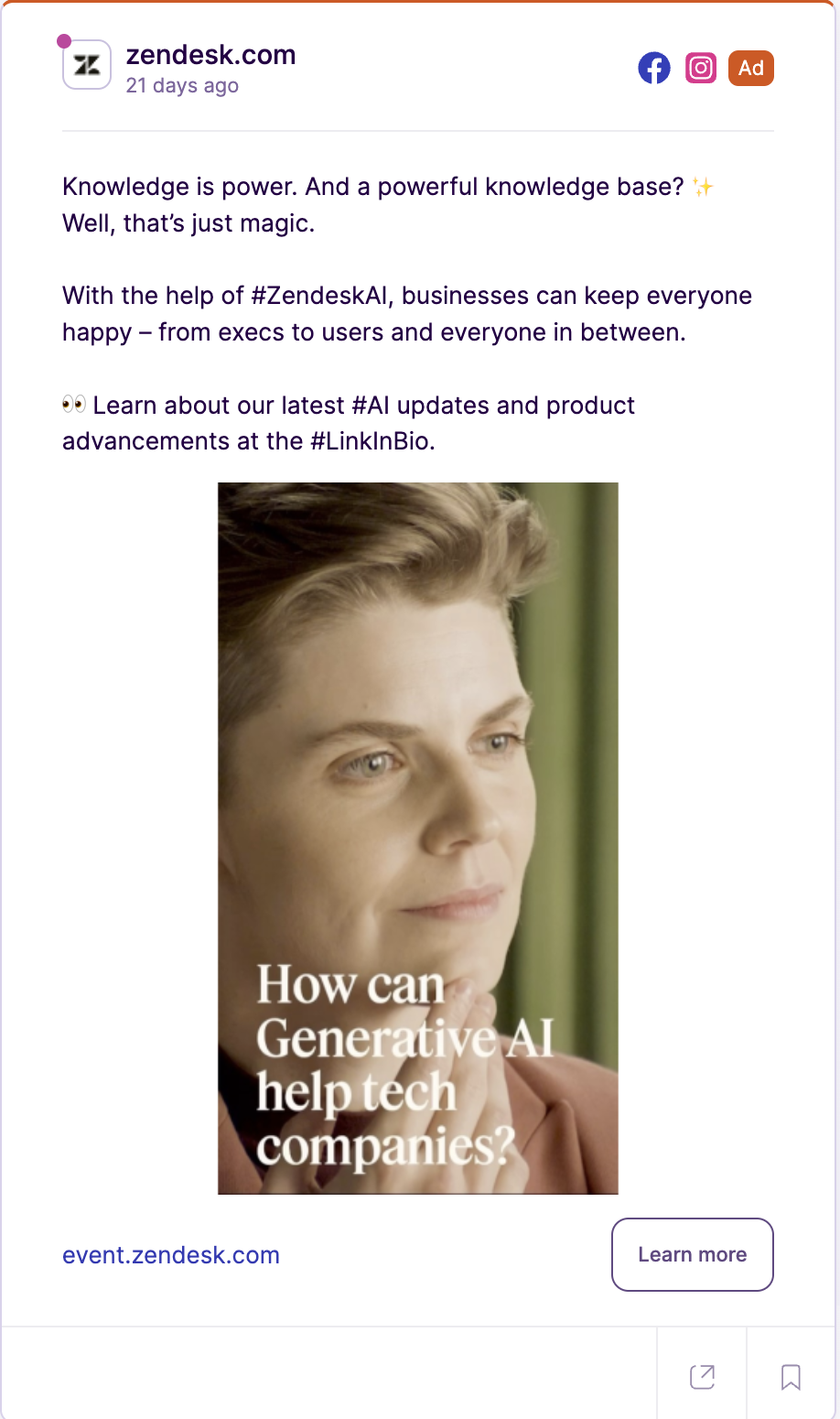

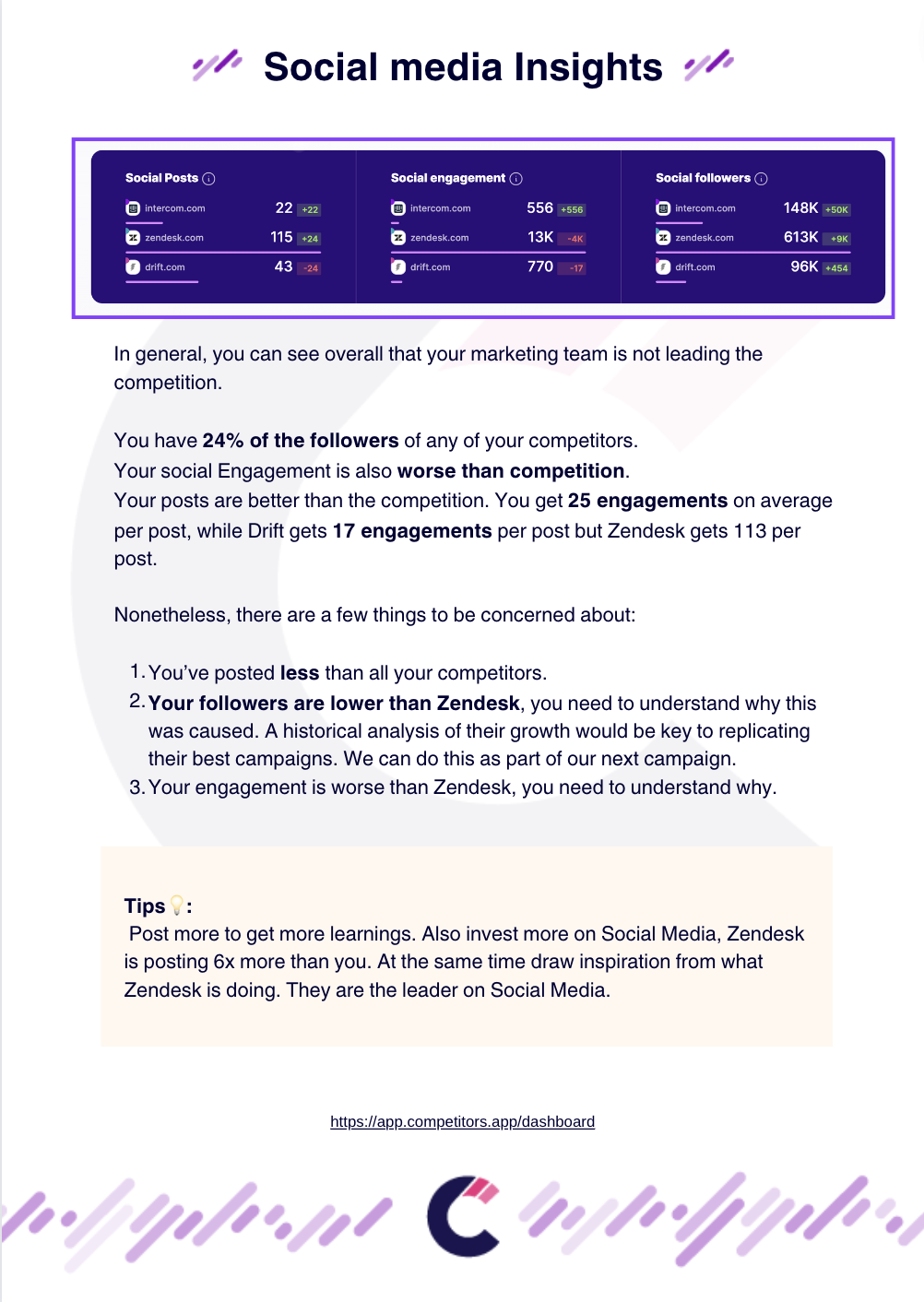

Competitive Intelligence Reports for Marketing Teams

Marketing teams can benefit from competitive intelligence reports by gaining a deeper understanding of competitors' advertising strategies, social media engagement, and content effectiveness. This can inform more strategic decision-making in areas like ad spend, content creation, and social media campaigns. Marketing teams can also use competitive intelligence reports to identify gaps in their competitors' strategies, providing opportunities to outperform them. For example, if a competitor is not effectively engaging with their audience on social media, your team could capitalize on this by ramping up your own social media engagement. Additionally, understanding the ROI of competitors' ad campaigns can help you allocate your own ad spend more effectively. Refer to the example on the left, which showcases a social media competitive report. This report can offer valuable metrics such as engagement rates, follower counts, and content performance, providing a comprehensive view of how your competitors are doing in the social media space. This data can be instrumental in shaping your own social media strategy and making data-driven decisions.

Tips for Writing the Competitive Intelligence Report

Creating a competitive intelligence report is not just about gathering data; it’s also about presenting that data in a way that’s easy to understand and act upon. Below are some guidelines and tips to consider when writing your report.

Best Practices

- Use a structured format that’s easy to follow.

- Incorporate visuals like charts and graphs to break up text and make data easier to understand.

- Always cite your sources to lend credibility to your findings.

- Make sure to include an executive summary at the beginning to give readers an overview of what to expect.

- Focus on actionable insights that can guide decision-making.

Common Mistakes to Avoid When Creating a CI Report

- Overloading the report with data but not providing any interpretation or actionable insights.

- Ignoring the needs of your audience by including too much industry jargon or overly complex analyses.

- Failing to update the report regularly, making the data and insights outdated.

Challenges in Competitive Intelligence

- Data Overload: The sheer amount of data that can be included might be overwhelming.

- Time Constraints: Gathering and analyzing data can be time-consuming.

- Ethical Considerations: Ensure that all data is gathered in an ethical manner, respecting privacy laws and regulations.

By adhering to these best practices and avoiding common pitfalls, you can create a competitive intelligence report that not only informs but also empowers decision-makers in your organization.

Tips for Presenting and Sharing the CI Report with Relevant Stakeholders

Once your competitive intelligence report is complete, the next crucial step is to share it with the stakeholders who will benefit from the insights. Here’s how to go about it:

Distributing Reports to Stakeholders

- Choose the appropriate channels for dissemination, whether it’s via email, a company intranet, or a dedicated reporting tool.

- Consider creating different versions of the report tailored to the needs of various departments or levels of management.

Sharing with Relevant Stakeholders

- Schedule presentations or meetings to go over the report’s key findings and actionable insights.

- Use visual aids like slides or dashboards to make the data more digestible.

Effective Presentation Tips

- Be clear and concise in your presentation, focusing on the most critical insights.

- Be prepared to answer questions and provide additional context where necessary.

Frequency of Reporting and Channels for Dissemination

- The frequency of reporting will depend on the industry, the level of competition, and the rate of change in the market. It could be monthly, quarterly, or even annually.

- Utilize multiple channels for dissemination, including digital platforms, printed copies, and in-person presentations, to ensure the report reaches all relevant parties.

The Need for Feedback and Continuous Improvement

- Encourage stakeholders to provide feedback on the report’s usefulness and clarity.

- Use this feedback for continuous improvement, both in terms of the report’s content and how it’s presented.

Tips for Making Discoveries Actionable: Strategies for Maximizing Competitive Intelligence

Creating a competitive intelligence report is only half the battle; the real value lies in implementing the insights you’ve gathered. Here’s how to make your discoveries actionable and maximize the utility of your competitive intelligence:

Prioritize Recommendations

Not all insights are created equal. Prioritize recommendations based on their potential impact and ease of implementation.

Align with Business Goals

Ensure that the recommendations align with your organization’s broader business objectives. This will help in gaining buy-in from key stakeholders.

Create an Action Plan

Develop a detailed action plan outlining the steps needed to implement each recommendation. Assign responsibilities and set deadlines.

Monitor Implementation

Regularly track the progress of your action plan. Use key performance indicators (KPIs) to measure the effectiveness of the implemented strategies.

Iterate and Adapt

The competitive landscape is ever-changing. Be prepared to adapt your strategies based on new insights and market conditions.

Cross-Departmental Collaboration

Competitive intelligence is not just a marketing or sales function; it impacts multiple departments. Ensure cross-departmental collaboration for a more holistic approach.

Measure ROI

Assess the return on investment (ROI) of your competitive intelligence efforts. This will not only validate the process but also help in securing resources for future initiatives.

By systematically implementing the recommendations from your competitive intelligence report, you can significantly improve your competitive positioning and make more informed business decisions.

Tips for Monitoring and Updating Your Report

Your competitive intelligence report is not a one-time effort but a living document that needs regular updates. Your role when starting and embracing competitive intelligence is to ensure that this document keeps getting better over time. Here’s how to keep it current and relevant:

Scheduled Updates: Consistency is key when it comes to competitive intelligence. Establish a regular schedule for updating your report, whether it’s monthly, quarterly, or annually. This ensures that your data remains current and actionable, allowing your team to make informed decisions.

Data & Objective Alignment: As your business evolves, so should your competitive intelligence report. Make sure to revisit your data sources and objectives regularly. Align them with your current business goals to ensure that your report remains relevant and serves as a useful strategic tool.

Stakeholder Feedback: Don’t underestimate the value of feedback from key stakeholders. After presenting the report, gather insights from your team, executives, and other stakeholders. Use this feedback to refine the scope, format, and content of future reports, ensuring they meet the evolving needs of your organization.

Automation & Review: Leverage tools like Competitors App to automate the tracking of competitor activities across multiple channels. While automation can save time, it’s crucial to review the collected data periodically. This allows you to adapt your strategies based on performance metrics and emerging trends.

Competitive Intelligence Reports are too important to be neglected

I hope this article helped you understand the critical role that Competitive Intelligence Reports play in today’s business environment. These reports are not just a collection of data; they are a roadmap for your business strategy, providing invaluable insights into your competitors, market trends, and opportunities for growth.

The key to leveraging these reports is to keep them updated and aligned with your business objectives. This is where tools like Competitors App can make a significant difference. With features like multichannel tracking and real-time email notifications, Competitors App automates the tedious aspects of data collection, allowing you to focus on strategy and decision-making.

If you’re serious about gaining a competitive edge, investing in Competitive Intelligence is a must. A well-crafted, actionable CI report can be your secret weapon in navigating the complexities of the market. So don’t neglect this vital business tool. Take the first step by trying out Competitors App and see how it can transform your approach to competitive intelligence.

1. What is Competitive Intelligence?

Competitive Intelligence (CI) is the practice of gathering, analyzing, and interpreting information about your competitors, market trends, and customer behavior to make informed business decisions.

2. What is the ideal Reporting Frequency to Various Stakeholders?

The frequency may vary depending on the industry and the rate of change in the competitive landscape. However, quarterly updates are generally recommended.

3. Why is industry analysis and monitoring market trends important in a CI report?

Understanding industry trends and market shifts allows businesses to anticipate changes, identify opportunities, and mitigate risks, making the CI report a proactive tool for decision-making.

4. Is competitive intelligence applicable to businesses of all sizes, or is it primarily for large corporations?

CI is applicable to businesses of all sizes. While large corporations may have more resources, small businesses can also benefit from focused, well-executed CI efforts.

5. How often should I update my competitive intelligence report?

Quarterly updates are generally recommended, but high-velocity industries may require more frequent updates.

6. Are there any legal boundaries or regulations to consider when gathering data for competitive intelligence?

Yes, it's crucial to adhere to legal and ethical standards, such as not engaging in corporate espionage or violating copyright laws.

7. What tools and software can help streamline the competitive intelligence process?

Tools like Competitors App can automate data collection and analysis, making the CI process more efficient.

8. What's the role of technology, such as artificial intelligence and machine learning, in modern competitive intelligence practices?

AI and machine learning can automate data analysis, provide predictive insights, and help in real-time decision-making.

9. How can I measure the ROI (Return on Investment) of my competitive intelligence efforts?

Measuring ROI could involve tracking metrics like increased market share, revenue growth, or cost savings attributed to CI initiatives.

10. Can competitive intelligence reports be tailored to specific departments within a company, such as sales, marketing, or product development?

Yes, CI reports can be customized to meet the specific needs and objectives of different departments.

11. What are the consequences of neglecting competitive intelligence in today's highly competitive business environment?

Neglecting CI can result in missed opportunities, reduced market share, and a lack of preparedness for market shifts.

12. How can I present my Competitive Intelligence Report effectively?

Using clear visuals, focusing on key insights, and tailoring the presentation to your audience can make your CI report more impactful.

13. Is Competitive Intelligence legal and ethical?

Yes, as long as it adheres to legal and ethical guidelines and is performed on public data, CI is both legal and ethical.